This is one of the major house issues that most homeowners always try to avoid is the crawl space foundation repair chesapeake va. Every homeowner wants to be able to trust their foundation to be strong enough to withstand any force or act of nature.

A foundation issue can be quite challenging and expensive, sometimes it can be an insignificant issue and there are issues that you will need to pay more than $10,000 to fix.

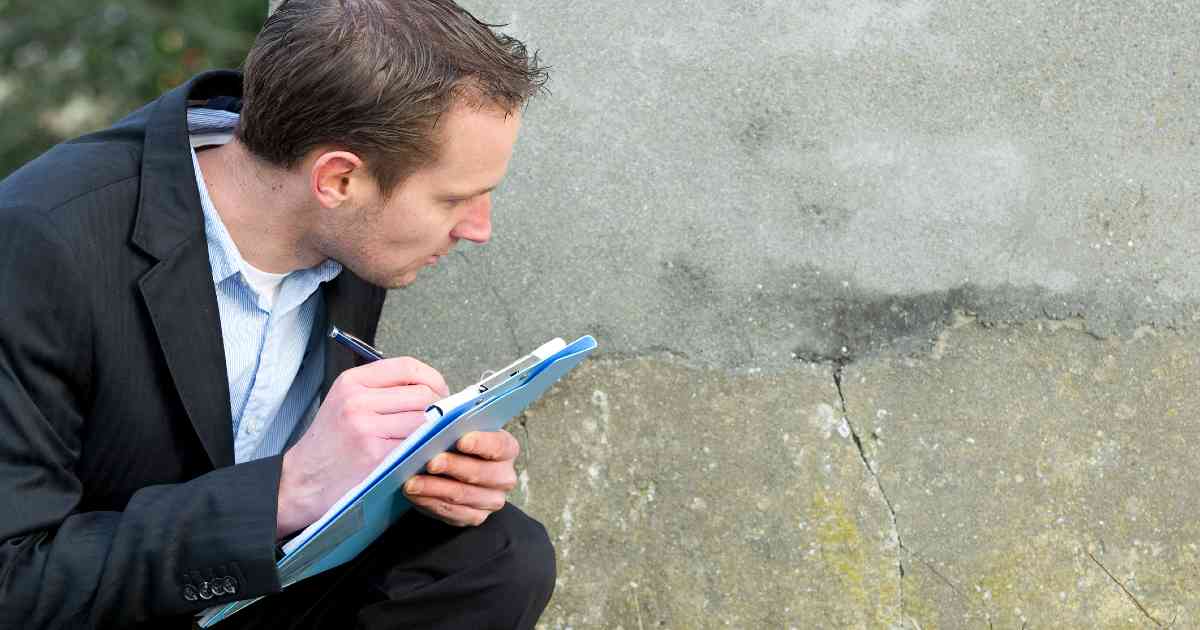

The best way to know the extent of damage to the foundation of your house is to hire a professional that will tell you the cause of the damage which will determine if a repair claim would be successful.

Does homeowners insurance cover foundation repair pueblo co? Yes, however, a lot depends on the cause of the damage. If you like to know whether your homeowner insurance company has a cover for foundation issues, you should read on.

Homeowners Insurance and Foundation issues

If you will like to know if your foundation issue will be covered by your house insurance foundation repair policy, the first step is to know the cause of the damage, most of the time, foundation issues are caused by earthquakes and tornados.

However, there are some other causes of foundation problems which include soil moisture challenges, faulty structure, tree root, and plumbing problems.

There is a part of your home insurance policy that covers every part of your structure which includes the foundation. However, similar to other parts of the policy, there are clauses and exceptions, if the cause of the issue is listed in the policy, then you can file a claim.

Most insurance companies will cover foundation repairs for issues such as fire, vandalism, earthquake, or a car driving into your house.

Issues that they won’t cover

It’s important to point out that there are some foundation issues caused by natural disasters that your insurer won’t cover.

If your house is located in an area that is prone to earthquakes or floods, you will need to invest in a separate insurance policy to protect both your properties and your foundation. They may not cover any foundation issue that is caused by soil moisture or earth movement.

Also, homeowner insurance companies will not offer you foundation insurance if the issue is caused by the deterioration of the property. Insurers believe that the maintenance of your home is your responsibility.

Insurers believe that you should be able to handle a tree root growing underneath your foundation or in the case of a faulty structure; you should hire a professional to examine the house before buying it.

How to file a claim

The first step is to hire a foundation expert to assess the damage and determine the cause, if the cause is listed under the policy, you can file a claim like you would for any other type of damage

Make sure that you call the expert as soon as you realize the problem; it will make it easier for the insurer to believe you. If the foundation issue was caused by vandalism, contact the police, obtain a police report, and then take the report to the insurer.

Once you have filed the claim, the insurer will send an agent to review the damage; this is where the assessment of your foundation expert will come in handy. The agent might argue that the issue was caused by natural wear and tear; it’s the responsibility of the expert to vouch for you.